Aspire Thought Leadership! Wondering about how to integrate ESG into corporate strategy? Find out more on how fortune 500 companies use this approach.

In order to have a robust integration of ESG into corporate strategy and be as effective as needed by investors, ESG effect should be deeply integrated into a company’s core strategy and organization at different levels. A strong focus on material information, a clear identification of ESG-related risks as well as a balanced and comparable presentation of the company’s nonfinancial performance will be critical.

Integrating ESG into the corporate strategy

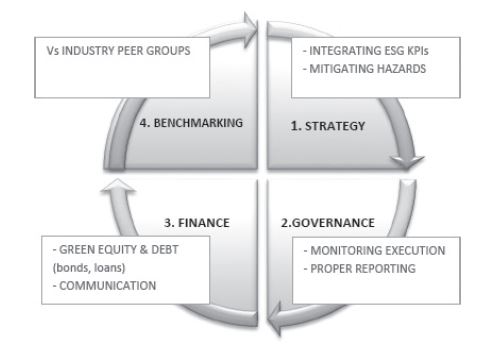

The following Exhibit presents the process a company should follow to effectively integrate ESG into the corporate strategy.

|

| Integrating ESG into the corporate strategy |

STRATEGY.

Because of its holistic dimension, the first critical step for a company is to translate its unique impact framework and metrics into a proactive ESG strategy that is integrated into the company business strategy with specific goals, targets, and KPIs. ESG impact has to be seen in the context of the company value chain and broader ecosystem, assessing not only positive contributions to ESGs, but also the mitigation actions aimed at reducing risks from hazards and their effects [value matrix]. All the best cases presented in this book illustrate how the strategy was formulated top-down by the company leaders and then implemented bottom-up, engaging employees and the wider community. The ESG strategy should also be translated into specific investment plans such as R&D, capital expenditures and other investments.

GOVERNANCE.

Monitoring the ESG strategy execution is the second step of this process. Monitoring bodies are part of the company’s corporate governance mechanisms, including effective supervision by the board of directors or a specialized CSR committee, internal control and audit, and reporting through the typical communication channels for financial and sustainability information. Remuneration committees are in charge of proposing remuneration systems that can be included in ESG as goals in Management by Objectives (MBO) programs. Moreover, it is important that reporting includes a better integration of nonfinancial and financial information. In order for nonfinancial information to be useful to investors, this information should be comparable across companies.

FINANCE.

The third step is about finding the right pool of financial resources. The ESG strategy should be financed as part of the overall corporate finance program, including loans, bonds, and equity. Initially, companies can leverage specific ESG assets or activities with more impact-oriented investors by issuing bonds with “green” use-of-proceeds and by strictly monitoring how these funds are used. For instance, in 2020, the privately owned luxury brand Chanel tapped public markets for the first time, issuing a $700 million sustainability-linked bond on the Luxembourg Stock Exchange. VF Corp, Burberry and Adidas have all taken on debt linked to environmental initiatives that cover investments into more sustainable materials and processes as well as projects that positively affect communities. Finally, a consistent financial communication, focused on disclosure and transparency of ESG issues, should be provided to investors, using all existing communication channels such as annual, sustainability and integrated reports or “roadshows” to targeted ESG investors.

BENCHMARKING.

Once a company’s ESG criteria are fully integrated in its strategy, they should be compared with those of industry peers. A benchmark is a reference point against which something is evaluated. Industry benchmarking can help identify key areas where companies in a specific industry can maximize positive effects while minimizing negative effects. Information such as carbon emissions, water use and health and safety data are commonly shared in the annual sustainability reports of companies globally and help investors assess – beyond traditional financial factors ESG information to better evaluate companies’ resilience and performance. As ESG information on the “best and worst” companies is quite valuable, there are issues on how sustainable and ethical data are measured, valued, and weighted: such issues need to be addressed and disclosed for an accurate picture that the public can trust. ESG scores can in fact play a key role in determining whether fund managers can buy a stock, how much companies pay on loans, and even if a supplier can bid for a contract. They can also help verify whether a bond is really “green” or if a company is eligible for a stock benchmark. Still, some important advancements need to be made in this realm. In the next paragraph, we present the state of the art of ranking and benchmarking initiatives. Although many companies have recently increased the practice of reporting on sustainability factors and initiatives, and despite the emergence of standards and frameworks including the GRI’s standards, as well as SASB and the TCFD recommendations, companies and investors often cite the lack of consistent and reliable sustainability disclosure as a key obstacle to integrating ESG into their businesses and investment processes. Sustainability reporting remains mostly voluntary.

Fashion and luxury companies and integrating ESG into corporate strategy

A sample of fashion and luxury brands (the Italian Ferrari, Cucinelli, Moncler and the American Ralph Lauren, Tiffany & Co and Nike) was analyzed with reference to their ESG strategy as presented in their annual reports in the period 2015–2019. Here are the main findings.

Environment

European brands show homogeneous results in terms of the progressive reduction of CO2 emissions and improved waste management with complete nonfinancial reporting on this topic. They also state that they have increased their investments to make operations more efficient and build renewable energy systems. American companies report more heterogeneous performances and discontinuous nonfinancial reporting. Nike is the best in class, reporting innovative solutions to improve on raw materials and the adoption of the circular design approach. Eco-friendly solutions within the supply chain are less developed compared with those of the Europeans.

Social

All European brands present good results in terms of supplier audits, they are all increasing the number of hours dedicated to employee training, while gender diversity is not yet satisfactory but improving. Corporate projects are in the area of work–life balance, technical education of workforce [mindfulness in the workplace], collaborations with local communities to protect the local cultural and artistic heritage. With the exception of Nike, American brands show limited reporting with neither information on audit practices or evidence of training hours. A strong narrative is however offered on diversity management and inclusion of minorities with the appointment of ad hoc organizational bodies (e.g., Responsible for diversity) and metrics.

Governance

European companies have made their organizational structure evolve with the definition of specific CSR committees and new inter-functional teams within or outside the board. In addition, they have designed remuneration plans partially linking executives’ variable compensations to ESG targets. American brands have rather enlarged the competencies of existing committees (e.g., risks committee) or concentrated these issues under the direct responsibility of the Company’s CEO or CFO. European companies show a more proactive and strategic approach to nonfinancial reporting with a rich narrative in terms of their branded supply chain. With these luxury brands being deeply connected to their local territories and communities, they value the people belonging to their ecosystem, these being employees or suppliers, investing in the dissemination of knowledge [customer value proposition]. American brands have a stronger narrative about people management, in particular, considering diversity and inclusion. The analysis, although reporting quite a high level of commitment and attention to the topic, confirms how long the road still is to objective and fair comparisons.

The benchmarking challenges

ESG ratings aim at presenting a full analysis of a company’s commitment to ESG practices, making evident and comparable the ESG practices implemented in comparison with peers within the same industry. The greater the number of approaches available to assess and score a company on its performances about ESG issues, the more difficult it is to compare results. This situation is creating a huge demand for services offered by organizations providing ESG ratings on how well companies are doing in addressing ESG concerns. External audits on financial information and sustainability information can be used for independent assessment of financial and nonfinancial information related to the implementation and results of an SDG strategy.

The World Economic Forum’s ESG Ecosystem Map intends to bring all the most relevant initiatives into a common framework to support companies and decision makers. Divided into nine sectors, the map features 60 key players in the global ESG landscape and shows how individual players are connected through partnerships and joint initiatives, data sharing [enterprise data management], and common founding members.

|

| Environmental Social Governance |

Nowadays ESG research, ratings and indices are mostly provided by two kinds of players.

- Financial market data providers such as MSCI, Morningstar (Sustainalytics), Thomson Reuters, Bloomberg and FTSE Russell, looking at expanding their business scope beyond risk-adjusted return concepts.

- Credit Rating providers (namely, Moody’s and Standard & Poor’s), willing to offer investors a way to screen companies for ESG performance in a similar way to how credit ratings allow investors to screen companies for creditworthiness.

Only a limited number of ESG rating agencies still remain independent (i.e., not linked to the two above), mainly private-owned, such as EcoVadis, Arabesque, Covalence, CSRHub, Ethos, Inrate and Oekom Research.

ESG rating providers generally calculate scores by scouting publicly available nonfinancial data, including company statements, news stories and reports from non-governmental organizations. The themes covered tend to mirror the 17 SDGs. But, while creditworthiness is clearly defined as the probability of default and therefore credit ratings assessed by different agencies rarely vary much, the definition of ESG performance is less clear, input can be different and also methodologies vary considerably, thus making different ESG ratings difficult to compare.

ESG ratings and AI

In 2020, Cerved - the leading rating agency in Italy and 5th in Europe acquired the ESG rating provider Integrate, whose ESG rating model uses Artificial Intelligence for its assessments, adopting around 180 ESG indicators. Data from nonfinancial reports published in accordance with international reporting standards is extracted and uploaded to Integrate’s proprietary database. The calculation algorithm provides a synthetic score, defined as an ESG score, which expresses the issuer’s ESG performance. Once the system identifies relevant information on ESG issues, the system automatically assigns an ESG score. For each indicator, the scorecard shows the value of the company, the median value of the industry sample and a traffic light score showing the relative position of the company within its sector. Integrate’s algorithm has shown an accuracy rate of 86–90% for data analysis relevant to the ESG profile. [artificial intelligence in business]

The Exhibit summarizes different rating methodologies and scales adopted by the most relevant ESG rating providers.

|

| Environmental Social and Governance |

The need for standardization

Sustainability Reporting was and continues to be a voluntary action conducted “beyond compliance”. Although relevant efforts have been made to bring more transparency and standardization, the lack of regulation makes ESG reporting and ratings less reliable than creditworthiness ratings focused on financial information. Company reporting is still highly individualized; companies control what and how to report, what is “material” and therefore should be reported, often without external validation of the accuracy or completeness of their disclosures. Many observers believe that a global and compulsory approach, with effective monitoring and sanctions for noncompliance, is absolutely essential to hold corporations accountable and avoid behaviors defined as “bluewashing” and “greenwashing”.

While Bluewashing is the alleged practice of companies claiming their participation in philanthropic activities to increase corporate influence on international organizations, greenwashing is about a firm gaining an unfair competitive advantage by marketing a financial product as environmentally friendly when in fact it does not meet basic environmental standards.

According to a recent survey, the lack of standardization in ESG disclosure is the number one reason companies claim for not disclosing their emissions records. With the European Union taxonomy – introducing disclosure requirements for index and benchmark providers – ESG rating providers will be called to provide full transparency over their ESG indexes, notably regarding methodologies, data sourcing and guidelines to include assets in their indexes, thus pushing the industry toward a higher-quality standard. Still, ratings providers say their systems will improve significantly, only if companies worldwide are forced to report relevant sustainability data [big data in retail], as the main challenge is lack of coherence in ESG disclosures by companies. The situation here varies across the globe. The EU, for instance, already obliges large companies to regularly publish reports on the social and environmental effects of their operations. The China Securities Regulatory Commission is making it mandatory for all listed companies and bond issuers to disclose ESG risks by 2020. The U.S. Securities and Exchange Commission, the financial regulator for the world’s largest economy, on the contrary, does not require corporate disclosure of material ESG data. Over the short terms, there are no plans in the US to address the lack of standardization in ESG definitions and processes.

While waiting for an international regulatory framework to be progressively composed, according to our perspective five types of initiatives could accelerate ESG integration and further boost the ESG investment trend.

- Asset managers could be pushing for a minimum level of best practices. For example, if there were a global consensus for a minimum standard of carbon intensity, incentives for companies to comply would be higher.

- National regulators could merge their initiatives with supranational institutions, such as the European Commission, the US SASB or the United Nations, when converting norms and principles around nonfinancial reporting standards into law.

- Investment research could better explain ESG concepts to help eradicate misunderstandings between management and asset managers.

- Fund rating agencies could expand their scope beyond risk-adjusted return concepts assessing ESG impact analysis of investment funds, as Morningstar is doing already.

- Asset owners are clearly more difficult to unite. However, their willingness to require ESG standards for asset managers may have the strongest effect on the pace at which assets are transformed into ESG-compliant investments [digital transformation strategy]. This is also backed by the demographic shift toward younger investing targets with a much stronger preference for ESG-compliant assets.