Aspire Thought Leadership! Ever wondered about blockchain industry?. Find out more on what has changed with blockchain industry in the current age. Co

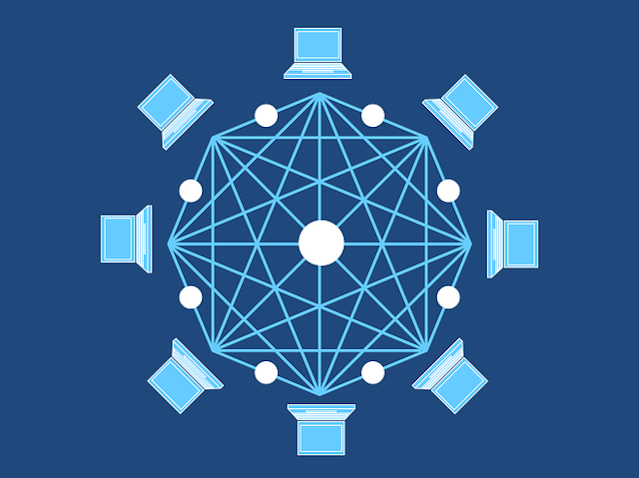

The hype around blockchain industry continues to build, and the disruptive potential is real as evidenced by the client applications cited in the post. Several market analysts estimate the blockchain market size to grow at a Compound Annual Growth Rate (CAGR) of 40.9% to 61.5% according to various analysts. Organizations are looking at blockchain for near costless transaction verification, transparency & immutability, and lower risk in business transactions.

As the world moves to overcome the hype surrounding blockchain, financial markets institutions are among the first to leverage the decentralized blockchain platform to define their futures. According to an IBM Institute of Business Value study, 14% of the financial markets institutions surveyed planned to go into blockchain production at scale in 2017, focused on payment clearing and settlement, wholesale payments, equity and debt issuance, and reference data. According to Accenture, the ‘tipping point’ will happen in 2018 when the early majority of financial services see the benefits of early adopters and new models emerge.

The significant factors in enterprise adoption of blockchain technologies are:

Ethereum intends to create an alternative protocol for building decentralized applications, via a blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats, and state transition functions.

Ethereum uses the Ethereum Virtual Machine (EVM) and the Solidity programming language to implement and execute peer-to-peer and multi-party agreements among other applications. It has no centralized authority, no government body or corporation behind it, and runs wherever there is the Internet.

In Ethereum, the state comprises objects called as “accounts.” There are two types of accounts-

Ethereum comprises multiple components. It uses Whisper for messaging so that Dapps can communicate with each other (e.g., record an offer to sell a commodity at a specific price on an exchange). Swarm is a distributed storage platform and also provides content distribution services. The aim of Swarm is to provide redundant and decentralized storage (e.g., Dapp code and data). The Ethereum Virtual Machine (EVM) executes computations and also tracks the state of millions of objects called accounts. Tracking of “states” is a critical component of smart contracts because the platform needs to track ether balances in a way similar to a bank certifying a customer has funds in his/her account.

Ethereum is a global singleton as the public nodes worldwide running Ethereum form the Ethereum World Computer. The Ethereum World Computer represents a robust cryptographic foundation on which to build next-generation information and decision-making systems that are secure, non-repudiable, uncensorable and transparent.

Since its launch, Ethereum has become the world’s de facto choice for developing distributed applications (called Dapps) and has facilitated the rise of Initial Coin/ Token Offerings (ICOs/ITO). Few examples of decentralized applications are a Universal Sharing Network of autonomous devices by combining blockchain with IoT (by Slock.it); platforms for prediction markets such as Augur and Gnosis; and secure identity systems such as uPort. Decentralized applications are applicable in every sector/ vertical and not just for the financial industry. They may use ether itself as its digital token or may issue tokens on top of Ethereum. However, it is important to note that transactions between Ethereum tokens are ether transactions itself from the network’s perspective and need gas for execution. [IoT and Blockchain]

Ethereum also enables building a decentralized and democratic organization called Decentralized Autonomous Organizations (DAO) that exists only on the blockchain. The governance rules of the decentralized organization are also part of the code (such as adding members and voting rules).

In May 2016, the company Slock.it created one of the first DAO. It was a complex smart contract running on Ethereum, and they funded it via a token sale in May 2016. The DAO was an investor-directed venture capital fund and provided investors with the ability to vote on future proposals.

An attacker exploited a security loophole in the DAO in June 2016 resulting in the draining of 3.6 million Ether (out of 11.5 million Ether committed to the DAO). The bug was not in the Ethereum blockchain network but in the distributed app built on top. The developers in a public blockchain network fix such issues by upgrading the client software running on the nodes to implement a change to the code. However, in certain circumstances not all nodes will upgrade the version of the blockchain code, which splits the blockchain into two (and hence the term ‘fork’). To fix this issue, the Ethereum developers had a choice between two types of forks:

Under Hyperledger’s umbrella are many projects that take different approaches to creating business blockchain tools and frameworks — Fabric, Iroha, Sawtooth, Burrow, and Indy.

Here are high-level goals of Hyperledger Fabric project:

Corda’s vision is a ‘global logical ledger’ with which all actors interact and one that allows any parties to record and manage transactions amongst themselves in a secure, consistent, reliable, private and authoritative manner. It differs from a blockchain in that an end-state of Corda is one where everybody sees the same data that pertains to them, but the physical implementation and storage of the ledger is different as compared to blockchain.

The global ledger in Corda is a reliable single source, but the transactions and ledger entries are not visible globally. Where transactions only involve a small subgroup of parties, Corda strives to keep the relevant data within that subgroup.

To summarize Corda:

Blockchain industry overview: Evolution

The blockchain market (what is blockchain?) has continued to evolve in the areas of technology and business applications.- Adam back invented the Hashcash Proof-of-Work function in 1997.

- In 1998, Nick Szabo introduced ‘bit gold’ as a mechanism for decentralized digital currency and smart contracts. A precursor to Bitcoin, it described a system for the decentralized creation of unforgeable proof of work chains, with each one being attributed to its discoverer’s public key, using timestamps and digital signatures.

- In 2000 Stefan Konst published a general theory for cryptographically secured chains and suggested a set of solutions for implementation.

- Satoshi Nakamoto then conceptualized the first blockchain in 2008 and implemented the following year as a core component of the digital currency Bitcoin where it serves as the public ledger for all transactions.

- The first transaction in Bitcoin happened in block #170, which paved the way for the first real-world transaction. On 22 May 2010, Laszlo Hanyecz made the first real-world transaction by buying two pizzas in Jacksonville, Florida for 10,000 BTC.

- By 2014, “Blockchain 2.0” was a term referring to new applications of the distributed blockchain database. The Economist described one implementation of this second-generation programmable blockchain as coming with “a programming language that allows users to write more sophisticated smart contracts, thus creating invoices that pay themselves when a shipment arrives or share certificates which automatically send their owners dividends if profits reach a certain level.” Blockchain 2.0 technologies go beyond transactions and “exchange of value without powerful intermediaries acting as arbiters of money and information.”

|

| Blockchain Industry Overview |

Blockchain industry: Market Opportunity

The addressable blockchain market revenue opportunity is $2.5B in 2018, growing to $15B by 2021, according to MD&I Trend Analysis. The bulk of the market will be addressable in the form of Services given that custom, services-driven projects will drive the market in the early years.- The biggest blockchain market is the Financial Services industry which has already adopted blockchain solutions in clearing, and near-real-time securities settlement, cross-border remittances, and equity swap. The investment will grow even more in new application areas in 2017 including more back-office operations such as regulatory reporting, and KYC (Know Your Customer) processes. [application of blockchain] Several analysts forecast the blockchain market of $67.2M in 2016 to grow at a CAGR of 56% through 2021.

- Analysts expect fastest adoption in the Healthcare/Life Sciences industries in 2017 in use cases such as clinical trial records, regulatory compliance, and medical/health records. They forecast the blockchain market $33.5 million to grow at a CAGRs of 66.5% through 2021.

- Government & Retail industries have strong blockchain use cases and increasing adoption. The benefits of blockchain solutions of transparency and immutability make it very appealing for Government use cases including digital voting and reducing fraud (such as in social services) through smart contracts and the Retail use-case of secure transactions. Other industries are growing blockchain adoption, including Media and Energy.

Blockchain industry: Top blockchain trends

- Proofs-of-concept will slowly move to production : There will be an increase in initiatives moving into production. Less than 5% of blockchain proofs-of-concept moving forward into production but this number will rise to double digits in the next 2 to 3 years as the technology matures and more skilled professionals are available.

- More traditional players and financial institutions will get involved in cryptocurrency : In the next few years, at least one Tier 1 bank will offer cryptocurrency services and Initial Coin Offerings (ICOs). Consumers expect digital money that cryptocurrencies provide is connected to the Internet and unconstrained by geography or institutions. With the rise of digital wallets and technologies like Apple Pay, people expect that transactions should be free and that foreign exchange should be immediate. These are factors that the financial institutions will consider in offering new services around cryptocurrencies.

- Blockchain ecosystems will become critical success factors : Memberships in consortiums and industry collaborations will increase. Business partners will align to ecosystems with easy-to-use APIs/tools, marketing support, and a clear revenue sharing model.

Growth Drivers for Blockchain

The survival of any organization depends on its ability to outperform competitors and marketplaces in attracting and rewarding talent, ideas, and capital. The pace of innovation has sped up as the transaction costs have plummeted with the rise of the Internet, leading to new platforms, business models and delivery of services and goods at unimaginable speeds. Startups take advantage of the changes in the underlying technology and lack of encumbrances by existing revenue streams (and associated costs and inertia) to challenge established businesses forcing them into foreclosure or rethinking of existing value chains.As the world moves to overcome the hype surrounding blockchain, financial markets institutions are among the first to leverage the decentralized blockchain platform to define their futures. According to an IBM Institute of Business Value study, 14% of the financial markets institutions surveyed planned to go into blockchain production at scale in 2017, focused on payment clearing and settlement, wholesale payments, equity and debt issuance, and reference data. According to Accenture, the ‘tipping point’ will happen in 2018 when the early majority of financial services see the benefits of early adopters and new models emerge.

The significant factors in enterprise adoption of blockchain technologies are:

- Loss of faith in existing financial systems : For the world’s financial systems to function, it is essential that the general population has faith in it. The earliest remnant of paper currency called ‘feiqian’ (‘flying cash’) as the Chinese called it during the Ming dynasty, declared their circulation to last forever, and that ‘to counterfeit is death’—extreme measures to introduce confidence in using paper currency instead of gold or silver. Fast forward to 2008 when the collapse of Lehmann Brothers had an enormous impact on the financial markets and erosion of trust—both system trust of citizens’ in their institutions, and the validity of the underlying principles. The resulting financial crisis and subsequent disclosures of wrongdoings from some of the world’s premier financial institutions further eroded trust. The U.S. Securities and Exchange Commission has charged over 200 entities and individuals with total penalties exceeding $3.76 billion. According to the Edelman Trust Barometer conducted in January 2009, for instance, 65% of all respondents (a figure that rises to 84% in France) agreed that their government should impose stricter regulations and greater control over businesses in all industries. A survey by the non-profit National Association of Retirement Plan Participants found that only 13% of 5000 respondents had faith in their financial institutions in 2015. The Chicago Booth / Kellogg School’s Financial Trust Index shows only 27.13% of Americans trust the nation’s financial system. This erosion of trust led to the rise of anti-capitalist and anti-globalization sentiments around the world, and a desire to eliminate existing intermediaries. Bitcoin gained mainstream attention in 2011 with Silk Road but before mining became profitable, there were thousands of people dedicating resources and efforts to the currency. Any visit to a Bitcoin discussion forum provides evidence that an important core of the BTC community comprises libertarians who want to see the end of all fiat currencies. Curiosity, profit and politics motivated the initial adopters of Bitcoin although there is evidence that the initial interest was also the ability to deal in illegal activities. Regardless, Bitcoin paved way to a host of cryptocurrencies where developers have forked the original Bitcoin codebase and created their own version known as altcoins. The current market capitalization of altcoins exceeds $58 billion.

- Change in consumer behavior : Everyday consumers want access to quick, convenient, and widely accepted payment methods. The two other waves of technological disruption happening with blockchain are the rise of social networks, and enterprise adoption of mobile technologies. 62% of US adults get their news on social media, e-commerce accounted for 11.7% of total retail sales in 2016, and mobile phones surpassed desktop and laptop computers in 2016. The rise of cryptocurrencies forced most countries to adopt initiatives for banks to do faster payments. The UK has Faster Payments, the Eurozone has SEPA, and the Chase introduced ClearXchange in the US. Companies had to adopt creative branding and social media strategies since millennials trust their peers over advertisements (which had a stronger impact with baby boomers). A recent FICO report showed that millennials are five times more likely than those over the age of 50 to close all accounts with their primary bank, have no patience for the traditional fees imposed by intermediaries (like ATM withdrawal fee) and are more likely to interact with a financial institution via an app rather than walk into a branch. Cutting edge Fintech startups and new market entrants have capitalized on these technological and consumer behavioral changes, causing disruption to the traditional value chain of financial institutions. The Fintech startups have focused on four primary areas—payments, personal finance management, lending and investments. Global venture investment in Fintech grew to $17.4 billion in 2016 according to PitchBook. ‘This signals Silicon Valley is coming. There are hundreds of startups with a lot of brains and money working on various alternatives to traditional banking’, according to Jamie Dimon, CEO of Chase. Francisco Gonzalez, Chairman and CEO of BBVA said ‘Up to half of the world’s banks will disappear through the cracks opened by digital disruption of the industry’. Fintech is democratizing the playing field, providing targeted solutions to a smartphone happy consumer who is less willing to walk into a bank account, and using technologies like blockchain for faster transaction times. People are becoming less reliant on banks and instead using apps to fulfill services offered by banks. For example, TransferWise or Xoom to send money, filing taxes with SimpleTax, and managing outstanding payments on Satago.

- Venture capitalist investment : Over 3 million people are estimated to be actively cryptocurrency like Bitcoin. The number of unique cryptocurrency wallets is estimated to be between 2.9 million and 5.8 million. This user adoption has also resulted in a direct impact on venture capital investment. According to an August 2016 report by the World Economic Forum (WEF), “The Future of Financial Infrastructure,” over $1.4 billion has been invested in the blockchain technology in just three short years. [examples of disruptive technology] Over 90 corporations have signed on to blockchain development consortia, with at least 24 countries now investing in blockchain research and development. The WEF predicts that by 2017, 80 percent of banks will engage in projects implementing blockchain technology. Financial institutions have taken part to the tune of $320 million—for example, Goldman Sachs invested in the $50 million investment round of peer-to-peer payment startup Circle; Nasdaq, Visa and Citi invested $30 million in Chain.com, and NYSE, BBVA invested $75 million in Coinbase. The increased investment from venture capitalists and the rise of blockchain consortiums has led to an increased adoption of the blockchain technology for enterprises. For example, Hyperledger experienced a 30% QoQ member growth in Q4 2016 passing 100-member milestone, R3 gained five new members and completed a KYC trial with ten banks. Proof-of-Concept activity continued to increase throughout 2016 with over 50 PoCs announced in Q4 2016 with over 120 unique participants. Major technology providers introduced blockchain services to capture the market and mindshare. Microsoft launched its Blockchain-as-a-Service (BaaS) for Microsoft Azure to help organizations develop, test and deploy blockchain applications. IBM introduced a blockchain service on its Bluemix Cloud based on Hyperledger, enabling developers to test blockchain technology and use in production via its High-Security Business Network service. Partnerships and collaborations continued to grow in the blockchain technology market. Microsoft announced a collaboration with ConsenSys and Blockstack to create an open source, self-sovereign, blockchain-based identity system that allows people, products, apps and services to interoperate across blockchains, cloud providers and organizations. Deloitte partnered with BlockCypher, Bloq, ConsenSys, Loyyal, and Stellar, to provide new technological capabilities to its global financial institution client base. Ripple added Standard Chartered, National Australia Bank (NAB), Mizuho Financial Group (MHFG), BMO Financial Group, Siam Commercial Bank (SCB) and Shanghai Huarui Bank to improve their cross-border payments using blockchain.

- Growing recognition of broader potential : Contracts, transactions, and the records of them are among the defining structures of our economic, legal, and political systems. With blockchain, we can imagine a world where contracts are code on the blockchain, and governed by the rules of the network and protected from deletion, tampering, and revision. In this world, every agreement, process, task, and every payment has a digital record and a signature that authorized network members can identify, validate, store and share. A recent report from Mckinsey & Company identified multiple, cross-industry use case categories that such as management of asset ownership & chain of custody, secure storage, confirmation, and distribution of identity-related information, exchange of assets on the blockchain, efficient payment transfers with lower friction and improved record keeping, and the use of blockchain to store information and access dynamic information. Blockchain will have the same foundational impact to digital transactions that TCP/IP did to the internet—unlocking of new economic value by lowering the cost of transactions. However, it is also clear that the proof-of-work method used by Bitcoin (and built people’s trust in the blockchain 1.0 world) is unsustainable. The energy consumption estimates for the Bitcoin network range from 334 MW per year to 774 MW per year, sufficient to power 268,000 to 627,100 American homes. As the value of Bitcoin increases, the competition for mining new Bitcoin increases, driving up the computation complexity and the associated electricity. This model is unsustainable in the long run. The World Economic Forum has argued that blockchain is a new global resource to record anything of value to humankind. Paul Brody, principal and global innovation leader of blockchain technology at Ernst & Young, thinks all our appliances should donate their processing power to the upkeep of a blockchain. A thousand blockchains can bloom—for intangible items such as coupons and vouchers, to physical assets like cars and homes; private blockchain networks to track contracts & wills, semi-public blockchains to store & verify credentials, HR records, etc. Public blockchains for easy access to certified practitioners, land registry titles, etc., and other blockchain networks for mobile phone SIM cards, etc. The world is awash with blockchain opportunities, and the broader applications are yet to come!

- Cost reduction and process improvement : The distributed ledger and consensus mechanism provided by blockchain eliminate the need for second and third parties to validate a transaction, reducing the time and costs to settle a transaction, conduct a vote, establish a contract, etc. For several decades, business process management systems have served as a framework to simplify business processes within and across organizations and provide better transparency in a business process such as claims handling, insurance underwriting, and order to cash processes. When the data required for a business process lives in organizational silos, the conventional approach is move data between silos to support the business process. This complicated and expensive approach puts stress on integration systems and the various parties to ensure each follows the rules of engagement. For example, consider the following illustration which shows six organizations collaborating with each other during the life-cycle of a vehicle. The parties are organizations such as a manufacturer, dealer, and leasing company. Each organization maintains its information systems with a subset of data in their private databases and want to keep changes to the state of the vehicle up to date throughout the life-cycle of the vehicle.

Challenges in Enterprise Adoption

There are many technical and business challenges that continue to be a barrier to mass adoption of blockchain. These include a variety of different vendor technical initiatives, a lack of proven and diverse use cases with sound business proposition, uncertainty over governmental regulation, and a lack of skills / developer tools.- Technical Platform issues : Perhaps the biggest hurdle in mass adoption of blockchain is lack a robust enterprise platform which provides the throughput required to augment existing business processes. Other technical challenges remain such as latency to validate a transaction. The confirmation latency in Bitcoin network takes about 10 minutes on average (though in reality that happens in only ~63% of the time, while ~12% of the time it will take longer than 10 minutes, and in 0.25% it can take over an hour). The transaction latency in Ethereum public is ~17 seconds. This pales when compared to enterprise systems which have requirements for processing of hundreds or even thousands of transactions per second. Other technical challenges around the size of the ledger, bandwidth required to update the ledger, scalability and storage requirements.

- Security & privacy concerns : If the distributed ledger records the transactions and stores confidential contractual information, it increases the attack surface for hackers to gain access. There are solutions that offer strong encryption, but integration of blockchains with existing systems requires a comprehensive security strategy for the entire business application.

- Lack of skills : Finding developers with the blockchain expertise is rare. Blockchain developer tools are nascent. These factors increase security risks and make the cost of developing with blockchain platforms higher than existing technology stacks.

- Regulation : Blockchain has potential to disrupt and radically transform commerce and governmental institutions. A decentralized approach to identity and transaction management reduces the control of governments and corporations. You can bet Government will want to regulate its adoption, which could impact the progress of blockchain solutions. Bureaucracy, lawyers, compliance, front office, back office, middle office may slow down meaningful reform implementation, or even getting a budget to expand a technology program.

- Culture : Changing from legacy systems is always hard. Blockchain will change business processes, models, and perhaps entire industries. Banks today make huge profits on financial transactions. If transfers suddenly became instantaneous and worry-free, bank risk losing a lot of revenue. Cultural adoption is crucial as blockchain requires a shift to a decentralized network which needs the buy-in of its users and operators.

- Lack of maturity of smart contracts : The siphoning of funds from the DAO is perhaps the most public exploit of a poorly written smart contract. A recent study found 34,200 smart contracts were vulnerable to either stealing of Ether, and could even freeze or delete assets in contracts that the attackers did not own. Implementing smart contracts require a significant amount of integration work and developers need to contemplate the boundary conditions for testing the smart contracts.

Key Blockchain Technologies & Consortiums

Industry groups formed many consortiums in 2017, with most of them geared towards the financial industry. Commercial use of blockchain will promote blockchain technologies that are general purpose or industry focused. This section summarizes some of the key associations and blockchain consortiums available in the marketplace today.Ethereum

Ethereum is a public, open source blockchain-based distributed computing platform launched in 2015, featuring smart contract functionality. It provides a decentralized virtual machine, the Ethereum Virtual Machine (EVM) that can execute peer-to-peer contracts using a cryptocurrency called ether. It has been under active development since 2014 by 30 core developers, led at a high level by Vitalik Buterin, a 20-year-old Canadian computer science prodigy with links to Peter Thiel. Buterin’s aim was to create a platform for developing decentralized applications. Ethereum exists as a public, permissionless or trustless network, similar to Bitcoin. It has 32,000 nodes mining on its Mainnet at the time of writing, ~125,000 smart contracts deployed, which translates to ~125,000 solutions of various sizes (although one project can have many smart contracts) running on the Mainnet.Ethereum intends to create an alternative protocol for building decentralized applications, via a blockchain with a built-in Turing-complete programming language, allowing anyone to write smart contracts and decentralized applications where they can create their own arbitrary rules for ownership, transaction formats, and state transition functions.

Ethereum uses the Ethereum Virtual Machine (EVM) and the Solidity programming language to implement and execute peer-to-peer and multi-party agreements among other applications. It has no centralized authority, no government body or corporation behind it, and runs wherever there is the Internet.

In Ethereum, the state comprises objects called as “accounts.” There are two types of accounts-

- Externally owned accounts: There is no code with them, and private keys control them. An externally owned account can send messages to both types of accounts by creating and signing a transaction using its private key.

- Contract accounts: A contract account has an ether balance and associated code. Transactions or messages received from other contracts trigger the code execution, and contract accounts perform operations of an arbitary complexity. Contract accounts cannot start a new transaction on their own.

Ethereum comprises multiple components. It uses Whisper for messaging so that Dapps can communicate with each other (e.g., record an offer to sell a commodity at a specific price on an exchange). Swarm is a distributed storage platform and also provides content distribution services. The aim of Swarm is to provide redundant and decentralized storage (e.g., Dapp code and data). The Ethereum Virtual Machine (EVM) executes computations and also tracks the state of millions of objects called accounts. Tracking of “states” is a critical component of smart contracts because the platform needs to track ether balances in a way similar to a bank certifying a customer has funds in his/her account.

Ethereum is a global singleton as the public nodes worldwide running Ethereum form the Ethereum World Computer. The Ethereum World Computer represents a robust cryptographic foundation on which to build next-generation information and decision-making systems that are secure, non-repudiable, uncensorable and transparent.

Since its launch, Ethereum has become the world’s de facto choice for developing distributed applications (called Dapps) and has facilitated the rise of Initial Coin/ Token Offerings (ICOs/ITO). Few examples of decentralized applications are a Universal Sharing Network of autonomous devices by combining blockchain with IoT (by Slock.it); platforms for prediction markets such as Augur and Gnosis; and secure identity systems such as uPort. Decentralized applications are applicable in every sector/ vertical and not just for the financial industry. They may use ether itself as its digital token or may issue tokens on top of Ethereum. However, it is important to note that transactions between Ethereum tokens are ether transactions itself from the network’s perspective and need gas for execution. [IoT and Blockchain]

Ethereum also enables building a decentralized and democratic organization called Decentralized Autonomous Organizations (DAO) that exists only on the blockchain. The governance rules of the decentralized organization are also part of the code (such as adding members and voting rules).

In May 2016, the company Slock.it created one of the first DAO. It was a complex smart contract running on Ethereum, and they funded it via a token sale in May 2016. The DAO was an investor-directed venture capital fund and provided investors with the ability to vote on future proposals.

An attacker exploited a security loophole in the DAO in June 2016 resulting in the draining of 3.6 million Ether (out of 11.5 million Ether committed to the DAO). The bug was not in the Ethereum blockchain network but in the distributed app built on top. The developers in a public blockchain network fix such issues by upgrading the client software running on the nodes to implement a change to the code. However, in certain circumstances not all nodes will upgrade the version of the blockchain code, which splits the blockchain into two (and hence the term ‘fork’). To fix this issue, the Ethereum developers had a choice between two types of forks:

- Soft Fork : A soft fork is backward compatible and required nodes with at least 51% of the ‘hashing power’ to upgrade so they will take control of the new blockchain formed by the new code, forcing non-upgrading nodes to upgrade or else waste the hashing power. However, the developers found a bug in the soft fork implementation few hours before rollout of the intended fix, and so they canceled it.

- Hard Fork : A hard fork is backward incompatible and is a change to the protocol that splits off one part of the blockchain. In the DAO fix, they implemented a hard fork. While this forking was a pragmatic decision so they could refund the ether drained from the DAO, ‘crypto-idealists’ or the purists were critical since forking went against immutability of the blockchain and ‘code being law.’ The miners who continued to support the non-upgraded chain called their network as Ethereum Classic.

- Development of open source standards

- Working with builders and doers towards a general purpose system

- Maintain compatibility with public Ethereum network

- Not reinventing the wheel on data standards

Hyperledger

Hyperledger is an open-source collaborative effort created to advance cross-industry blockchain technologies. It is a global collaboration, hosted by The Linux Foundation, including leaders in finance, banking, Internet of Things, supply chain, manufacturing, and technology.Goals

The Hyperledger project has advanced cross-industry blockchain technologies with the following objectives:- Create enterprise-grade, open source, distributed ledger frameworks & code bases to support business transactions

- Provide a neutral, open, & community-driven infrastructures backed by technical and business governance

- Build technical communities to develop blockchain and shared ledger POCs, use cases, field trials and deployments

- Educate the public about the market opportunity for the blockchain technology

- Promote our community of communities taking a toolkit approach with many platforms and frameworks

Under Hyperledger’s umbrella are many projects that take different approaches to creating business blockchain tools and frameworks — Fabric, Iroha, Sawtooth, Burrow, and Indy.

- Sawtooth - Hyperledger Sawtooth is a modular platform for building, deploying, and running distributed ledgers. Hyperledger Sawtooth includes a novel consensus algorithm, Proof of Elapsed Time (PoET), which targets large, distributed transaction validator populations with minimal resource consumption.

- Iroha - Hyperledger Iroha is a business blockchain framework designed to be simple and easy to incorporate into infrastructural projects requiring distributed ledger technology.

- Fabric - Intended as a foundation for developing applications or solutions with a modular architecture, Hyperledger Fabric allows components, such as consensus and membership services, to be plug-and-play. Started with IBM, Fabric has received the lion’s share of developer involvement although this has changed recently with the investments in Sawtooth. Fabric has a modular architecture and application developers create smart contracts (called “chaincode”), which are Go scripts running inside a Docker container. They released version 1.0 of Fabric using the PBFT consensus algorithm in June 2017. Besides IBM, other contributors include Huawei, DTCC, London Stock Exchange, DAH, and a bunch of smaller startups.

- Burrow - Hyperledger Burrow is a permissionable smart contract machine. The first of its kind when released in December 2014, Burrow provides a modular blockchain client with a permissioned smart contract interpreter built in part to the specification of the Ethereum Virtual Machine (EVM).

- Indy - Hyperledger Indy is a distributed ledger, purpose-built for decentralized identity. It provides tools, libraries, and reusable components for creating and using independent digital identities rooted on blockchains or other distributed ledgers for interoperability.

Hyperledger Fabric

Hyperledger Fabric is a blockchain framework implementation and one of the Hyperledger projects hosted by The Linux Foundation. Intended as a foundation for developing applications or solutions with a modular architecture, Hyperledger Fabric allows components, such as consensus and membership services, to be plug-and-play. Hyperledger Fabric leverages container technology to host smart contracts called “chaincode” that comprise the application logic of the system. [smart contracts in blockchain]Here are high-level goals of Hyperledger Fabric project:

- Private and Permissioned . Members of a Hyperledger Fabric network enroll through a Membership Services Provider (MSP).

- Extensible & Pluggable architecture Hyperledger Fabric offers several pluggable options. It can store ledger data in multiple formats, offers switching of consensus mechanisms, and it supports different MSPs.

- Shared Ledger . Hyperledger Fabric has a ledger subsystem comprising two components: the world state and the transaction log. Each participant has a copy of the ledger to every Hyperledger Fabric network they belong to. The world state component describes the state of the ledger at a point in time. It’s the database of the ledger. The transaction log component records all transactions which have resulted in the current value of the world state. It’s the update history for the world state. The ledger comprises the world state database and the transaction log history.

- The smart contracts in Hyperledger Fabric are called chaincode and an application external to the blockchain invokes them when that application needs to interact with the ledger. In most cases chaincode only interacts with the database component of the ledger, the world state (querying it, for example), and not the transaction log.

- Privacy of participants in the network : There are scenarios where some participants in the network will want to transact with others but do not want rest of the network to have details about the transactions. Fabric provides this capability via Channels.

- Consensus : Hyperledger Fabric writes transactions to the ledger in the order in which they occur, even though they might be between different participants within the network. The network establishes the transaction order and has a method for rejecting erroneous and malicious transactions.

Corda

Formed in 2014, Corda is a distributed ledger platform developed by R3, geared towards the financial world. Although blockchain inspires it, Corda is a distributed ledger and not a blockchain.Corda’s vision is a ‘global logical ledger’ with which all actors interact and one that allows any parties to record and manage transactions amongst themselves in a secure, consistent, reliable, private and authoritative manner. It differs from a blockchain in that an end-state of Corda is one where everybody sees the same data that pertains to them, but the physical implementation and storage of the ledger is different as compared to blockchain.

The global ledger in Corda is a reliable single source, but the transactions and ledger entries are not visible globally. Where transactions only involve a small subgroup of parties, Corda strives to keep the relevant data within that subgroup.

To summarize Corda:

- There is no “central ledger.”

- Each network peer maintains a separate vault of facts (similar to rows in a database table)

- All peers of a shared fact store identical copies.

- Not all on-ledger facts are shared with other peers.

- The ledger is immutable. It is easy to analyze a static snapshot of the data and reason about the contents.

- Transaction ordering: It is impossible to mis-order transactions due to reliance on hash functions to identify previous states.

- Consensus: it establishes transaction validity and uniqueness before committing an update to produce a new state.

Key Concepts

- The fundamental object in Corda is a state object which is a digital document which records the existence, content and current state of an agreement between two or more parties. It defines the ledger as a set of immutable state objects, and Corda’s aim is to ensure that all parties to the agreement remain in consensus ‘as to this state as it evolves’. Corda’s focus on states of agreement is in contrast to systems where data over which participants mustreach consensus represents the state of an entire ledger or the state of an entire virtual machine.

- Corda applies updates to the ledger using transactions, which consume existing state objects and produce new objects. It commits a transaction proposal only if it:

- Doesn’t contain double-spends

- Is contractually valid

- Is signed by the required parties

- Consensus is the mechanism via which transactions achieve both validity and uniqueness, to ensure contractual validity and prevent double spending. Parties can agree on transaction validity by independently running the same contract code and validation logic, but consensus over transaction uniqueness requires a pre-determined, independent observer.

- Flows are lightweight processes used to automate the process of agreeing ledger updates.

COMMENTS