Aspire Thought Leadership! Ever wondered about Blockchain Applications and Use Cases?. Find out more on what has changed with Blockchain Applications

In this post, we discuss blockchain applications and use cases from around the world. I have selected applications from across various industries financial institutions, retail, transportation, and logistics, etc., to provide a flavor of the innovative applications possible with blockchain for enterprise.

When applied to the food supply chain, blockchain can store digital product information (such as farm origination details, batch numbers, factory and processing data, expiration dates, storage temperatures and shipping details) along every step of the process.

All members of the business network agree upon the information captured in each transaction; once there is a consensus, it becomes a permanent record that no one can alter. Each piece of information provides critical data that might reveal food safety issues with the product. The record created by the blockchain can also help retailers better manage the shelf-life of products in individual stores and further strengthen safeguards related to food authenticity.

Contaminants that make people sick are a culprit of consumer woes and can be a costly issue for grocers to tackle. “It’s been reported that a 1% reduction in food-borne disease in the U.S. would amount to about a $700 billion saving to the U.S. economy,” according to Frank Yiannas, VP of food safety, Walmart. “But it’s more than just cost; it’s people. The CDC [Centers for Disease Control] estimates that about 48 million Americans will experience foodborne illness in the U.S., and the global numbers are even larger.”

IBM and Walmart worked together to perform the test on Chinese pork, and US mangoes, which proved that they could now trace food origins, a process which once took weeks in 2.2 seconds. They tracked products with blockchain technology through scans as they traveled from farms to Walmart shelves, recording various pertinent product details on an immutable ledger. [examples of disruptive technology]

In this application, all participants on the food supply chain from the farmer or breeder to manufacturer, distribution centers, retail stores, consumers and auditors, all have an association with the data stored on the blockchain.

|

| Blockchain Applications and Use Cases |

Blockchain Applications and Use Cases: Food Traceability

The tracking of food supply chain to establish the veracity of the produce, it’s handling and processing, and to establish provenance is critical to finding and helping address the sources of contamination in the food supply chain worldwide.When applied to the food supply chain, blockchain can store digital product information (such as farm origination details, batch numbers, factory and processing data, expiration dates, storage temperatures and shipping details) along every step of the process.

All members of the business network agree upon the information captured in each transaction; once there is a consensus, it becomes a permanent record that no one can alter. Each piece of information provides critical data that might reveal food safety issues with the product. The record created by the blockchain can also help retailers better manage the shelf-life of products in individual stores and further strengthen safeguards related to food authenticity.

Contaminants that make people sick are a culprit of consumer woes and can be a costly issue for grocers to tackle. “It’s been reported that a 1% reduction in food-borne disease in the U.S. would amount to about a $700 billion saving to the U.S. economy,” according to Frank Yiannas, VP of food safety, Walmart. “But it’s more than just cost; it’s people. The CDC [Centers for Disease Control] estimates that about 48 million Americans will experience foodborne illness in the U.S., and the global numbers are even larger.”

IBM and Walmart worked together to perform the test on Chinese pork, and US mangoes, which proved that they could now trace food origins, a process which once took weeks in 2.2 seconds. They tracked products with blockchain technology through scans as they traveled from farms to Walmart shelves, recording various pertinent product details on an immutable ledger. [examples of disruptive technology]

In this application, all participants on the food supply chain from the farmer or breeder to manufacturer, distribution centers, retail stores, consumers and auditors, all have an association with the data stored on the blockchain.

- Breeders or Farmers can provide information securely on the raw materials or feed used in the farms, type of fertilizer used, audit logs from visits from food safety inspectors, etc.

- Manufacturers provide information about the machinery used, and the processing performed at the farm including adherence to food safety standards such as NSF and HAACP. They also create product packages with electronic bar code based information labels for use by regulators and consumers.

- Distributors may aggregate products into bundles, or disaggregate packages for distribution into retail stores.

- Retail stores have full visibility into the product packages across transport lines.

- Consumers have visibility at the checkout till, or via mobile app, and can view the compliance data for any product including judging the veracity of meats, organic produce, etc.

- Auditors and food safety inspectors have end-to-end visibility of each product path across the supply chain, and check compliance of machinery to food safety standards, certify the food supply chain and generate audit records.

|

| Blockchain Applications and Use Cases - Food Traceability |

Benefits

“The benefits are many,” Yiannis said. “When people talk about the food safety benefits, for example, when there’s a food scandal - often what will happen is health officials will say we’ve seen illnesses documented in the country, and we think consumers shouldn’t eat, for example, spinach.”

“What happens is everybody’s guilty until proven innocent, all of this product comes off of the shelf, it incriminates everybody,” he said. “When the dust settles you find out it was one supplier, maybe one production line - so if you could identify this, you could target and remove the product and protect people from getting ill.”

Other benefits include:

- Supplier / Vendor Information and Certifications and associated Product certifications will be on the Blockchain

- Product date/batch code, shelf-life/expiration date, and factory information can be stored on the QR-Code and on the blockchain. Testing information can also be stored on the blockchain.

- 3rd parties can also use the app to store the inspection reports on the blockchain; they can retrieve a product and associated report using smart contracts in blockchain and checked for validity

- Products will be aggregated and disaggregated on the blockchain, with barcode scan events

- Package scans by trucking companies at various points can register the current location/state of goods on the Blockchain

- They can impose different regulations at different locations by writing regulations as Smart Contracts

Walmart expects consumers could interact with labels on their food, perhaps using a smartphone app, to bring up the journey of the product and any other information they want to see. This would require the active participation of many other big players in the food industry to work. The food supply chain is a complex food system, there is a lot of actors and players in it, and a blockchain solution for food transparency needs to be collaborative, and the project wants as many people in food production to be involved and engaged in it.

Blockchain Applications and Use Cases: Diamond tracking and fraud prevention

Authenticity and transparency is everything in the world of luxury goods. Risk emerges when provenance is broken, and risk fuels the three biggest black markets: theft, fraud, and cybercrime. Risk allows for the movement and trafficking of counterfeit goods across international borders and the proliferation of commodities like blood diamonds that help to fund terrorism around the world.

According to the Association of British Insurers, 65% of fraudulent claims go undetected costing the industry over £45 billion per year. Knowing a precious stone’s origin can stop fencing and insurance frauds and winnow out synthetic diamonds or those sourced in war zones. But forged paper certificates make provenance hard to verify. The diamond trade is marred by fraud and worse, as nefarious actors often trade rough diamonds out of conflict zones to fund violent insurgencies in places like Sierra Leone, Liberia, and Angola.

In 2000, the UN adopted the Kimberley Process: a rough diamond certification system widely adopted to stamp out the trade of so-called ‘blood diamonds’, by demanding proper documentation for any stones shipped out of 80 selected regions. Its goal is to promote the trading of diamonds from legitimate sources and to ensure that consumers can be confident in the origin of their diamond purchases.

Tracking a diamond from the mine to the retail store is a tricky process and is far from perfect. There are many parties involved in the business network workers, the mining company, sorting, distribution & trading agencies, cutting & polishing companies, distributors, and retailers. The diamonds are sent for certification after mining and cutting. Certificate houses inspect the diamonds, while laboratories grade them using the 4C’s - cut, carat, clarity, and color. Certification houses then serialize the stones and issue physical certificates with all the attributes of the diamond, including the girdle dimensions and hand-drawn line pictures. These certificates follow the diamonds into retail chains and increase the price of the stones considerably. While the Kimberly Process is a paper-based and prone to tampering by the parties in the supply chain,

Everledger aims to create a global digital registry for diamonds, powered by the blockchain. Everledger creates a digital thumbprint for each diamond, using the four c’s besides over 40+ metadata points, linking this information to the laser inscription on the bottom of the stone. Combined with high definition photography, they write all of this data onto the blockchain creating a permanent, digital thumbprint of an item.

| Blockchain Applications and Use Cases - Diamond tracking and fraud prevention |

Diamond supply chain

“Blockchain is immutable; it cannot be changed, so records are permanently stored,” says Kemp. “Information on the blockchain is cryptographically proven by a federated consensus, instead of being written by just one person.”

With this information, Everledger knows who owns which diamond and where it is. It can even trace the movement of diamonds on platforms such as eBay and Amazon as they are bought and sold. Everledger works with insurance companies when diamonds are reported stolen, and alongside Interpol and Europol where diamonds are crossing borders and entering black markets. The incentive for insurance companies to get involved is to reduce claims fraud and also recoup costs associated with paying out claims.

Blockchain Applications and Use Cases: Dispute Resolution for Commercial Financing

IBM Global Financing (IGF) is the world’s largest technology financier with over 125,000 clients in 60 countries. IGF provides channel financing for a worldwide network of over 4,000 suppliers and partners where partners get a credit line to purchase from the suppliers. In 2014 IGF financed $44 billion in over 2.9 million transactions. About 25,000 disputes arise per year over issues such as the wrong number of computer parts in an order or deliveries that go awry. Up to $100 million in capital is tied up in disputes, with average disputed invoice amount of $31,000.

The information about a transaction is split among many parties, so no one has a clear view of the entire transaction. It it takes an average of 44 days to resolve such issues. Employees use six to seven software application of blockchain to verify steps taken in the arrangement and having to call banks, financial institutions, and associated partners.

Without blockchain, participants in the transaction:

- Lack end-to-end visibility, from invoice to cash

- Use incompatible systems

- Have no end-to-end view of the progress of goods and payment

- Have to launch a dispute to resolve issues

- Waste time, tie up money and strain relationships

The IGF blockchain solution brings all the partners, suppliers and IGF to use the same distributed ledger so all participants have access to the most up-to-date version of the truth.

|

| Blockchain Applications and Use Cases - Dispute Resolution for Commercial Financing |

IBM Global Financing on Blockchain

- When a partner places an order, they add the PO information on the blockchain

- The supplier may approve or reject The transaction

- IGF verifies approval on blockchain and provides credit

- The supplier sends the shipment. All participants have insight into the status.

- Supplier submits the invoice to IGF

- IGF initiates a remittance to the supplier

- All participants can verify proof of delivery by the supplier

- Upon proof of delivery, IGF notifies partner of payment due.

- Partner issues payment to IGF

With blockchain, participants in the transaction:

- Share a single platform with permissioned and secure access

- Receive a full view of the process

- Easily track from purchase order to product delivery

- Can drill down to see all steps in the process

- Can see exact moment when a delay or error occurs

- Remedy problems without filing a dispute

- Achieve on-boarding and quick installation without disruption

Using blockchain improves many key operational parameters such as capital settlement time, the number of disputes, and time to resolve the dispute. The resulting capital efficiency and a reduction in working capital are the key benefits of the blockchain solution.

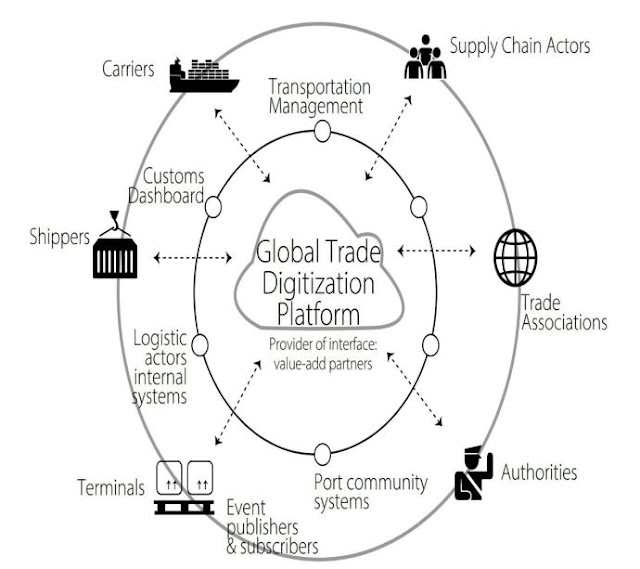

Blockchain Applications and Use Cases: Global Trade Digitization

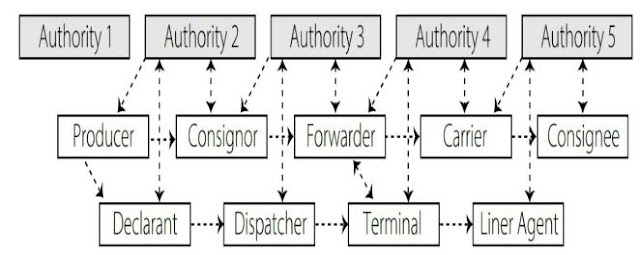

Ninety percent of goods in global trade is carried by the ocean shipping industry each year. Maersk found in 2014 that just a single shipment of refrigerated goods from East Africa to Europe can go through nearly 30 people and organizations, including over 200 different interactions and communications among them. Inefficiencies plague global supply chains by:

The shipping industry process today is a complex system where actors are communicating back and forth and data is stored locally at each actor’s site

The participants in the global supply chain face several key challenges:

|

| Global supply chain challenges |

IBM and Maersk together are building a global solution for sharing trade data among ecosystem partners designed to transform the international supply chain. The solution will not only digitize the entire supply chain process but enhance transparency and the highly secure sharing of information to provide a more integrated flow of data among trading partners, financial institutions, governments and logistics companies.

The Global Trade Digitization solution, built using blockchain, is an immutable, secure and trusted shared network. They use it for tracking exchanges of critical information and documentation such as records of inspection, bills of lading, customs documents and final receipt of goods. Throughout the transaction, each participant has access to end-to-end visibility across the supply chain, based on their level of permission. The new solution will manage and track over 10 million shipping containers, providing an unprecedented level of transparency and trust that will help reduce or eliminate fraud and errors, reduce the time products spend in the transit and shipping process, improve inventory management, and reduce waste and cost. [IoT and Blockchain]

|

| IBM and Maersk Global Trade Digitization Platform |

Some participants of the solution include:

- Customs Administration of the Netherlands who had been looking to expedite the customs and export processes for years. This is a way for the government to play a leading role in empowering smaller players to enter the global trading economy.

- A Maersk Line container vessel transports goods from Schneider Electric from the Port of Rotterdam to the Port of Newark in a live shipment using the solution.

- S. Customs and Border Protection took part on the receiving end of the live shipment.

- Damco, Maersk’s freight forwarding company, supported origin management activities of the shipment while using the solution.

- The solution was developed in close cooperation with the European Commission services (Directorate-General Migration and Home Affairs and the Directorate-General for Taxation and Customs Union), under the EU FP7 CORE demonstrator project.

Potential benefits for supply chain actors because of adoption of blockchain:

|

| Benefits of adopting block for global shipping industry |

Blockchain Solution for Derivatives Processing

The Depository Trust and Clearing Corporation (DTCC) is the central bookkeeper for Wall Street’s securities trades. DTCC provides a Trade Information Warehouse (TIW) service which automates the record keeping, life-cycle events, and payment management for more than $11 trillion of cleared and bilateral credit derivatives (98% of all Credit Derivatives traded worldwide). Over 2,500 buy-side firms such as mutual funds and pension funds in over 70 countries use the TIW service.

In the current process of derivates processing, TIW is a central warehouse where the metadata about the trades lives–things such as the type of instrument (equity, bond, or warrant), issue details (short name, long name, size, denomination, etc.) exchange rates, currency information, and other information. TIW keeps a copy of the record, and each of the participants also trades within their ledgers, and they reconcile between DTCC’s records and their records. This makes it a complex process where multiple parties have to agree to the same information and require a complex reconciliation process to arrive at a mutual consensus in processing the transactions.

DTCC decided in 2017 to re-platform the TIW solution, in partnership with IBM, Axoni, and R3 through a distributed ledger technology framework to drive improvements in the derivates post-trade life cycle events. This will enable DTCC and its clients to further automate and reduce the cost of derivatives processing across the industry by removing disjointed, redundant processing capabilities and associated reconciliation costs. They will deploy the solution in several stages, with an “end-state vision” to establish a permissioned distributed ledger network (i.e., private) for derivatives - governed by industry-owned DTCC with peer nodes at taking part firms. They have developed it with input from several big banks including Barclays, Citi, Credit Suisse, Deutsche Bank, J.P. Morgan and UBS and key market infrastructure providers, IHS Markit and Intercontinental Exchange.

|

| Vision for processing of credit derivates on blockchain |

The phased solution approach depicted in the picture above shows a pragmatic approach to run the distributed ledger version of the service and database in parallel with the existing version of the TIW service, processing and storing trades on both platforms. Once the project has achieved confidence in robustness and scale, DTCC will decommission the legacy TIW platform and progress to phase 2, which includes participant adoption of nodes on the distributed ledger network.

DTCC confirmed that although the ledger is distributed, DTCC will continue to play the role of central authority, which has several benefits. They can ensure well-defined processes for code deployment, and access controls mechanisms and permissioning. This central governance is vital for the confidence of market participants and the regulatory community.

Digital ID and Authentication

The first e-commerce website appeared over 20 years ago, yet we still use the same username, password and security question combinations to log in online. Human resources departments are filled with paper files of photocopied passports and Social Security cards. And, just like more than half a century ago, someone going to a bar still has to show a stranger a driver’s license full of identifiable information (name, address, date of birth) to prove they are old enough to drink.

The methods for managing identities in this digital age is antiquated. It’s inefficient, as consumers and businesses re-enter the same information to access many services. At worst, it’s dangerous, as the many high-profile data breaches of the past several years show.

Banks see themselves are stewards of identity – they would serve as authenticators. A single, federated identity would provide several benefits:

- It would be much easier for the banks to know who they are dealing with if they could get quick access to a token or digital certificate that established a person’s identity.

- Regulatory compliance would be easier and cheaper (both regarding money spent and internal resources dedicated to this task) to adhere to processes such as KYC

- Improved security since personal information would not be strewn across multiple systems in multiple banks eliminating the number of systems that require encryption, PII compliance, etc.

There are many benefits for consumers/end user as well:

- Control the aspects of their ID that would be shared between banks or divisions of a bank. For example, the app could vouch that a customer is old enough to drink in a pub, so they don’t have to show a driver’s license with an exact birthdate, or confirm their last three addresses to a landlord, saving both parties time spent looking up old lease documents or checking references.

- Individuals need not provide all personal information every time they consume a new bank service since they KYC information they have provided to avail a service from a bank can be reused repeatedly.

- Reduced risk of loss of personal data due to potential hacks or breaches at different providers (financial institutions or other e-commerce websites). Most people re-use the same username/password combination across websites so once a breach happens, the proportional risk of loss of data on other websites increases.

SecureKey Technologies partnered with IBM to enable a new digital identity and attribute sharing network based on blockchain. The network makes it easier for consumers to verify they are who they say they are, in a privacy-enhanced, security-rich and efficient way. Consumers can use the network to verify their identity for services such as a new bank accounts, driver’s licenses or utilities.

Once it goes in 2017 Canadian consumers will opt-in to the new blockchain-based service using a mobile app. Consumers – or network members – will control what identifying the information they share from trusted credentials to the organizations of their choice, so that those organizations can validate the consumer’s identity and arrange new services. For example, if a consumer has proven their identity with their bank and a credit agency, they can grant permission to share their data with a utility to create a new account. Since the bank and the credit agency have already gone through extensive verification of the consumer’s identity, the utility can rely on the fact that the information is verified, and they can approve the consumer for new services.

|

| The Concierge Identity System |

Canada’s leading banks, including BMO, CIBC, Desjardins, RBC, Scotiabank, and TD joined the digital identity ecosystem in October 2016, investing $27M in SecureKey. The Digital ID and Authentication Council of Canada (DIACC) and the Command Control and Interoperability Center for Advanced Data Analytics (CCICADA), a research center of excellence funded by the U.S. Department of Homeland Security Science & Technology Directorate, have also funded bring the new approach to digital identity to market. SecureKey’s leadership in Identity is clear by its association with blockchain industry leaders and regulators such as DIACC, Privacy By Design, NIST, FIDO, OIX, Kantara and the Linux Foundation.

COMMENTS