Aspire Thought Leadership! Ever wondered about examples of disruptive technology?. Find out more on what has changed with examples of disruptive techn

We are living in a world that is data-driven. Modern computer systems have collected approximately 20% of world’s data in the past few years. In this digital and networked world, we have a counterpart in the form of a digital identity in cyberspace to represent an individual, organization or electronic device. Like its physical counterpart, digital identity comprises a set of attributes such as username and password, date of birth, and other user-supplied or derived attributes. In this post let's run through the examples of disruptive technology.

Examples of disruptive technology : Identity

Identity plays a crucial role in our lives – from the moment we wake up and check email, consume news from either news aggregation websites or social media, to getting on a plane – identity governs every aspect of our lives even though we may not realize it. Further, the attributes linked to digital identity increase in number and sensitivity as the importance of the systems systems we interact with increases in association or impact, both in cyberspace and real life. For example, newsletters or messaging applications may only require an email address, while interaction with financial institutions may require additional attributes like social security number and date of birth. |

| Examples of disruptive technology |

Identity was a physical construct and the governments verified and issued official documentation such as a passport after verification of the information provided by citizens. However, about 1.5 billion people cannot establish their own identity to satisfy pre-requisites for getting a government issued ID which excludes them from property ownership, social protection, and even financial systems.

The need for trusted digital identity is increasing with the rise of smartphones, which affects transaction volumes for identity-dependent transactions and customer expectations for omnichannel delivery. Other factors include the growing complexity of transactions involving different entities (where identities may not be established offline for example, in cross-border payments) and increasing speed of financial or reputational damage (in case of security breaches).

Digital identity is a multi-layered, global issue. Each person has several digital clones (or representations) stored in data silos across every institution and organization with whom they have a relationship (for buying, selling, or renting of good and services). Each person had on average 25 online accounts that required a password in 2006, and the number of accounts we use is growing at 14, meaning it doubles every 5 years. Apart from the mind-boggling fact that this would mean we would have over 200 online accounts by 2020 secured by less than unique passwords per individual on average, this shows that our online identity is now as important as traditional, government-issued identity. Apart from the complexity of managing passwords, rapid digitization of the world economy is changing the way citizens think about their own identity:

Our ideas of personal identities and who we are in the physical world tie us to physical, biological and sociological attributes we carry with ourselves. Some of these attributes are immutable – such as our biometric data. As the bulk of interactions move to the digital world, the connections between the evolving senses of identity are loose, and not may other identity aspects have all of an individual’s data. The inherent identity attributes may not change (such as biometrics or family data), while accumulated (such as health records, bank accounts, club memberships) and assigned attributes may change over time (such as country of residence, passport number, visa numbers).

A robust online identity system must satisfy three attributes:

The Internet and the rise of e-commerce websites evolved our thinking and solutions for online identity. The solutions for online identity have evolved in four broad stages since the Internet:

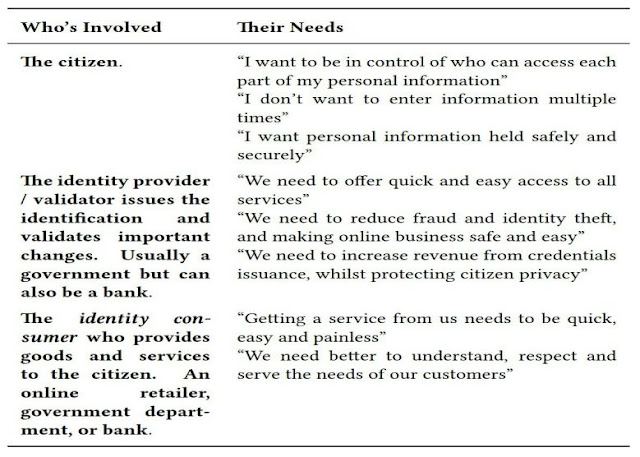

Another emerging design pattern is the rise of Identity Custodians – companies formed as part of a consortium between the participants identified in the table above which spans the citizens, identity providing companies (or Identity Custodians), and identity consumers who may be Identity Custodians.

The blockchain identity services landscape is still evolving, with both mature vendors and start-ups investing in developing general and special-purpose solutions.

The need for trusted digital identity is increasing with the rise of smartphones, which affects transaction volumes for identity-dependent transactions and customer expectations for omnichannel delivery. Other factors include the growing complexity of transactions involving different entities (where identities may not be established offline for example, in cross-border payments) and increasing speed of financial or reputational damage (in case of security breaches).

Digital identity is a multi-layered, global issue. Each person has several digital clones (or representations) stored in data silos across every institution and organization with whom they have a relationship (for buying, selling, or renting of good and services). Each person had on average 25 online accounts that required a password in 2006, and the number of accounts we use is growing at 14, meaning it doubles every 5 years. Apart from the mind-boggling fact that this would mean we would have over 200 online accounts by 2020 secured by less than unique passwords per individual on average, this shows that our online identity is now as important as traditional, government-issued identity. Apart from the complexity of managing passwords, rapid digitization of the world economy is changing the way citizens think about their own identity:

|

| Change in citizens’ view of identity |

Our ideas of personal identities and who we are in the physical world tie us to physical, biological and sociological attributes we carry with ourselves. Some of these attributes are immutable – such as our biometric data. As the bulk of interactions move to the digital world, the connections between the evolving senses of identity are loose, and not may other identity aspects have all of an individual’s data. The inherent identity attributes may not change (such as biometrics or family data), while accumulated (such as health records, bank accounts, club memberships) and assigned attributes may change over time (such as country of residence, passport number, visa numbers).

A robust online identity system must satisfy three attributes:

- Security: It must protect the identity information, including all inherent, accumulated and assigned attributes from nefarious and unintentional disclosure.

- Control: The owner of the identity (be it an individual, organization or a digital entity) must be in control of who can see and access the attributes associated with the identity.

- Portability: The identity owner must be able to port the identity attributes between solutions and not tied to any provider.

|

| Identity Creation, Protection and Consumption |

The Internet and the rise of e-commerce websites evolved our thinking and solutions for online identity. The solutions for online identity have evolved in four broad stages since the Internet:

- Centralized – Most Internet identities are centralized, ie, owned and controlled by a single entity such as a website or a social network. This is non-transferable to external entities, resulting in proliferation of IDs and passwords we know.

- Federated – Federation gives portability to identity, by enabling a user to sign into multiple services using the same credentials. Within a large organization, it may carry more complex credentials and ownership across applications. The most common examples are enterprise directories such as Microsoft Active Directory, or the use of Facebook and Google ID across several websites on the Internet. In this model, multiple, federated authorities keep administrative control of identity.

- User-Centric – The idea behind user-centric identity is to build a ‘persistent online identity’ into the fabric of the next generation of the Internet or web 2.0. This effort, called Identity 2.0, led to the basis of the OpenID standard and formation of OpenID foundation. OpenID allows user authentication by a third-party service, enabling users to login into multiple unrelated without having separate username and passwords for each. However, some argue that OpenID is another form of central authority, and other implementations such as Facebook Connect have been launched, defeating the original user-centric idea of control.

- Self-Sovereign – This is the final step in the evolution of online identity, and provides all three elements of security, control and portability. It turns identity owner and provider upside down – the identity owner becomes the provider and can own, control and manage their identity. The identity owner can see the attributes associated with their identity, reveal select attributes to a service provider, and can share the attributes with other providers to get a new service. Conventional approaches to identity have struggled with portability, and self-sovereign identity ushers in the post-silo, distributed world. Each organization can have a single connection to the collective network providing the identity layer, and access the identities and associated attributes via APIs.

|

| Timeline of evolution of blockchain and digital identity |

Blockchain value in distributed identity network

Blockchain can develop a trust platform for decentralized, citizen-centric identity. Using blockchain for an identity network differs from earlier approaches and makes in citizen-centric and even self-sovereign in following ways:- The citizens (or identity providers) own and control their identity along with all associated attributes and assets attached to that identity.

- The identity information is stored on a distributed ledger provided shared with all participants.

- It does not rely on third parties for the creation of identity, or validation of transactions associated with an identity.

Another emerging design pattern is the rise of Identity Custodians – companies formed as part of a consortium between the participants identified in the table above which spans the citizens, identity providing companies (or Identity Custodians), and identity consumers who may be Identity Custodians.

The blockchain identity services landscape is still evolving, with both mature vendors and start-ups investing in developing general and special-purpose solutions.

- Several startups are looking for ways to expand in the space of blockchain across industries. For example, BlockVerify provides blockchain-based anti-counterfeit solutions in industries such as pharmaceuticals, luxury items, diamonds, etc. BlockAuth enables users to own and operate their own identity registrar that allows them to submit information for verification. Trunomi empowers customers to manage and safely share personal data, with consent and control especially to adhere with incoming new regulations such as General Data Protection Regulation in EU.

- Pure-play blockchain identity providers are developing solutions and growing via partnerships. For example, Netki provides open source and open standards-based digital identity solutions that allow financial service companies to meet their compliance requirements on both public and private blockchains. Shocard enables customers to create a self-certified digital identity based on a government-issued ID, storing encrypted and hashed identity information on the blockchain.

- Startups providing blockchain-based identity platform are focusing on enabling developers to build applications rapidly with easy to consume APIs. For example, BlockCypher is an infrastructure fabric provider for blockchain applications and its APIs enable developers to build & interact with applications for identity management, p2p payments, etc. Blockstack provides a decentralized DNS system running on top of Bitcoin, removes any trust points from the middle of the network by using blockchain, and provides services for identity, discovery, and storage.

- Mature platform providers such as Microsoft have partnered with Labs and ConsenSys to build an open-source blockchain based identity system that integrates the Bitcoin and Ethereum blockchains.

- Thought leaders that have written multiple reports on Blockchain industry in FSS but have yet to develop tangible solutions. Their work is enabling companies to realize the potential of Blockchain capabilities. Deloitte and PwC have Identified Blockchain identity as a potentially valuable service and announced “Smart identity” and “Vulcan platform” respectively.

- Russia’s Alfa Bank collaborated with BlockNotary to release a mobile app called Potok to enable remote customer loan interviews and ID verification. The app holds loan interviews online, which speeds up the identification process. BlockNotary is a blockchain startup developing tools to solve problems related to compliance with KYC and AML requirements. BlockNotary’s remote customer ID verification software and service allows banks or vendors to safely accept new customers without requiring them to come into an office by video recording them speaking a script and showing their state-issued ID, then timestamping that video on the blockchain.

- Capital One announced a partnership with blockchain vendor Gem and healthcare API vendor PokitDok to address healthcare claims management issues. The technology will control who can have access to data stored in disparate systems and when they should have that access. Capital One and Gem will also use data analytics developed along with healthcare API platform vendor PokitDok to build a new claims service that uses blockchain to track claims for medical clients and estimate patients’ out-of-pocket healthcare costs. Gem’s core product is GemOS, an abstraction layer designed to make blockchains useful for enterprise clients by connecting their existing software to shared ledgers, and it serves as a platform for managing data, identities and rules on a blockchain.

- BlockCypher and ShoCard have partnered to provide an identity management solution that is being used for passenger identities in travel and transportation by SITA. SITA is an IT and communication services provider to the global airline industry and owned by a broad network of air travel service providers. With ShoCard, SITA developed a mobile traveler app that acts as a mobile single travel token that enables airlines, airports, or governments to verify passengers anywhere in the world. BlockCypher allows companies to switch from one chain to another by providing the same APIs across blockchains since BlockCypher is blockchain agnostic.

Decentralized Applications (DApps)

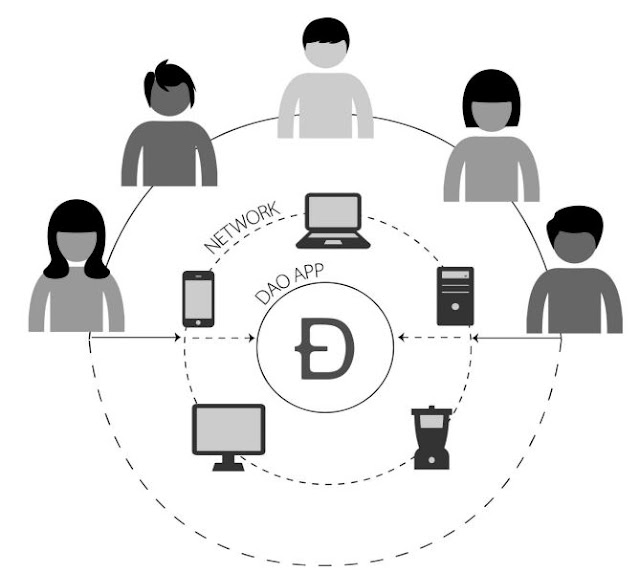

A new paradigm of applications has emerged with the rise of Bitcoin and its open source, peer-to-peer network, cryptographic storage of records (blockchain), and the usage of tokens to power the network. Such applications represent a new software paradigm designed to exist on the Internet not controlled by any single entity. [IoT and Blockchain]

A DApp must meet the following criteria:

- The application must be open-source, and operate autonomously, with no entity controlling most its tokens. It must store its data and records of operation in a blockchain.

- The application must generate tokens according to a standard algorithm, and distribute some or all of its tokens when it begins operating. These tokens must be necessary for using the application, and it should reward any contribution from users in the application’s tokens.

- The application may adapt its protocol in response to proposed improvements and market feedback, but a majority consensus must decide all changes.

By the above definition, Bitcoin is a DApp as is Ethereum. The Turing complete smart contracts in Ethereum have a way for development of Ethereum-based DApps such as the crowdsource predictions platform Gnosis, a system to reward good communication called SlackCoin, and blockchain based virtual nation that is altering the way we look at politics and how we govern ourselves called BitNation.

The DApps built on Ethereum are of the following types:

- Infrastructure: DApps that provide wallets, exchanges, developer tools and frameworks.

- Organizational Automation: DApps that provide automation of business processes within an organization.

The Ethereum white paper splits DApps into three types: apps that manage money, apps where money is involved (but also requires another piece), and apps in the “other” category, which includes voting and governance systems. If blockchains could do away with financial authorities, could it do the same for other companies and functions within the organizations? What if there was an organization where no single entity was in control, but it codified the rules and governance of the organization as a DApp? This most ambitious type of app led to a leaderless organization called DAO.

Examples of disruptive technology : DAO

Imagine a self-driving car summoned via a mobile app. After dropping someone off the car uses its profits to refuel itself at a charging station. Apart from its initial setup, it does not require outside help to determine how to carry out its mission.

Mike Hearn is a former Bitcoin contributor who has conducted thought experiments of systems and organizations that do not require outside help after the initial setup. Mike described how Bitcoin could power leaderless organizations, in his idea of a Decentralized Autonomous Organization (DAO), which swirled around the Bitcoin community after its release in 2009.

|

| Distributed Autonomous Organization |

A whitepaper by Christoph Jentzsch, Chief Technology Officer of Slock.it, memorializes the concept of a DAO Entity. The White Paper describes “the first implementation of a [DAO Entity] individuals working together outside of a traditional corporate form can use code to automate organizational governance and decision. A registered corporate entity can also use it to automate formal governance rules in corporate bylaws or imposed by law.” The whitepaper proposes an entity - a DAO Entity— that would use smart contracts to solve governance issues it described as inherent in traditional corporations. As described, a DAO Entity would supplant traditional mechanisms of corporate governance and management with a blockchain such that contractual terms are “formalized, automated and enforced using software.”

The DAO was an autonomous organization created by Slock.it UG (“Slock.it”), a German corporation and Slock.it’s co-founders, to operate as a for-profit entity that would create and hold a corpus of assets through the sale of DAO Tokens to investors, which assets would then fund “projects.”

Because Ethereum backed the DAO, they could program complex business logic, such that the organization would be unstoppable once set in action. The blockchain would record all business transactions, and organizational changes on an immutable public ledger, authenticated and controlled by an extensive, decentralized network of computers. Further, since digital token-holding “investors” fund the organizations spawned by The DAO, each organization would in effect be managed by its investors!

The DAO was launched on April 30, 2016, at 10:00 am GMT/UTC (by several “anonymous” submissions associated with DAOhub, who executed the open source bytecode on the Ethereum blockchain), with a set funding or “creation” period of 28 days. The DAO went live with about USD 250m in funding breaking all crowdfunding records. However, after the minimum two weeks “debating” period, on June 17, 2016, The DAO’s code was “exploited” by an unknown individual which used unintended behavior of the code’s logic to rapidly drain the fund of millions of dollars’ worth of tokens in a recursive call exploit. Slock.it, the leaders of the Ethereum platform, several cryptocurrency exchanges, and other informal technical leaders stepped in to stem the bleeding shutting down “exits” through the exchanges to stop the draining of Ether, and launching counter-attacks. The codified governance structure the key tenet of the DAO - broke down, and they disbanded the whole project, with a hard fork rolling back the “immutable” ledger.

While history records DAO as a failed experiment, the incredible potential of DAOs is alive and marching forward, as next sections would discuss.

Initial Coin Offerings (ICOs)

ICOs, or initial coin offerings (also known as ‘token sale’ or ‘coin sale’), are a funding mechanism that has been used by blockchain start-ups over to kick-start platforms and projects built on a cryptographic token, like Ether, Golem, Filecoin, or Storj. Instead of accepting some fund’s money for equity stakes, these firms issue their digital currencies, or tokens, that anyone can buy in a crowdsale. Proceeds from the auction of these virtual shares help fund the businesses.

Enterprenerus use a Smart contract on the Ethereum platform to manage ICOs, such that the created tokens are distributed to participants with transparent parameters such as exchange rates. Investors send Ether or Bitcoin to this smart contract address and receive tokens. Owners of these tokens can trade them on secondary markets like cryptocurrency exchanges, and sometimes they are also the means by which users pay to use the platform or decentralized application (dApp).

The first ICO of note was the Mastercoin fundraising in the summer of 2013, which offered tokens on its platform for Bitcoin, raising 5,000 Bitcoins. In early 2014, Ethereum itself raised money to kick-start its blockchain platform, collecting over $18 million. One of the most notorious ICOs, and perhaps a forerunner for this current wave of fundraises, was the DAO, a decentralized venture fund build on Ethereum that raised $160 million of tokens.

ICOs have raised almost $1.3 billion in 2017 so far, while only about $358 million in traditional VC money went to blockchain startups over the same period. Browser startup Brave raised $34 million in 30 seconds, Ethereum-based enterprise management platform Aragon raised $25 million in about 20 minutes, and Bancor raised $140 million in a few hours. The rise of investment in ICOs was likely due to technological maturity and innovations like ERC20 standard in Ethereum, and financing of projects by selling cryptographic tokens had reached a critical mass over the previous three years through a series of sustained experimentation in ‘alt-coins’.

The tokens offered in ICOs are of several types. Asset tokes represent ownership of an asset such as company, a piece of art. Usage tokens (also called ‘intrinsic’ or ‘native’) are transaction fees to write to a blockchain. Work tokes give owners permissions to contribute, govern and work on a blockchain. Hybrid tokens have properties of two or more tokens.

A typical pattern is for a startup to produce a white paper that describes their business model and technical approach. The white paper includes details about the functions that the tokens issued during the ICO will perform and the process of token creation. The tokens have a real added value – i.e., access to the network and used within the application itself. The contributors to the ICO sale get paid in tokens, which they can convert to fiat currency, and the goal of the token sale is to build the Network Effect.

Distributed applications are at the core of ICOs. Startups develop an application (or application suite) which interacts with the smart contracts that enforce the rules around the token exchange and connect the application to a blockchain such as Ethereum.

The regulatory status of ICOs is uncertain since regulation has not kept up with the pace of development in the ICO space. From a regulatory standpoint, there is no definitive agreement on what tokens are. Users can use tokens to buy and sell goods and services like currencies; but like precious metals, tokens act as commodities or assets that store value or perform a function (such as, ‘usage tokens’), and like equities and packaged investment products, tokens act as financial instruments.

A ruling by the United States Securities and Exchange Commission concluded that some of the ‘coins’ offered in token sales are in fact securities and subject to the agency’s regulation. A press release accompanying the report stated that ‘The federal securities laws provide disclosure requirements and other important protections of which investors should be aware. The bulletin reminds investors of red flags of investment fraud, and that new technologies like blockchain may perpetrate investment schemes that may not comply with the federal securities laws’.

According to the Swiss Financial Market Supervisory Authority FINMA, cryptocurrency business requires no special license, and they do not consider digital currencies securities but assets.

The People’s Bank of China issued a ban on ICOs on Sep 4, 2017. The Chinese authorities have concerns about several issues including illegal sale of tokens, illegal securities issuance, and illegal fundraising, financial fraud, pyramid schemes and other criminal activities.

Building blocks for a decentralized future

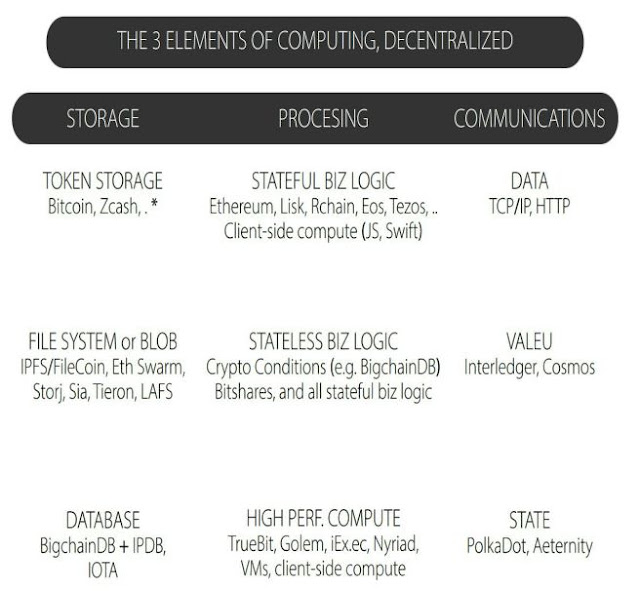

To build higher level decentralized systems, there must first be robust systems for storage, compute and bandwidth. Trent McConaghy defined the following classification helpful in scoping decentralized applications:

|

| Classification of decentralized applications |

The Storage layer provides the ability to store assets of value (such as tokens, or other assets). It may store structured metadata about transactions or other characteristics of the assets in a decentralized database such as BigChainDB or CouchDB. Specialized filesystems such as IPFS may store large, multimedia files.

The Processing element requires the ability to handle both stateless and stateful business logic, and the potential to support High-Performance Computing (HPC). Stateless business logic support is necessary to execute decentralized smart contracts. Stateful business logic is the arbitrary business logic that retains state internally but it also executes on the blockchain. It may require HPC support for blockchain applications and use cases such as rendering, machine learning, and weather simulation.

The Communications layer provides support for connecting business networks in three layers: transport layer to establish data interchange via protocols such as TCP/IP or HTTP, exchange of value (such as tokens or other assets) over the transport protocol while ensuring problems such as double-spend don’t happen, and interchange of state information across business networks that may run on different blockchains.

Enterprise Implications of DApps

So how can enterprises enjoy the innovations and advantages of DApps?

Innovation framework / incentives: The ability of any organization to outperform the market is limited by its ability to take an idea from concept to reality. However, the nature of large organizations forces establishment of a typical innovation funnel, encouraging frontline employees to submit their ideas which are then voted, ranked, approved and funded by several layers of middle-management before formal development projects can begin. DApps enable massive collaboration across such innovation frameworks, where companies can issue tokens (to show voting or internal investment funds) on a private blockchain, and allow decentralized decision making across the enterprise. This enables large groups of like-minded individuals to decide on ideas they perceive as most innovative, without interference from a middle-management chain limited by the innovator’s dilemma.

Business Process Improvements – In existing organizational models, decision making process is slow and costly. DApps can simplify these processes, by recording everything on the blockchain, and automating all associated processes with smart contracts in blockchain.

Strategic Decision Making – In all large organizations, few individuals on the corporate board at the top of the hierarchy make strategic decisions. Board members may have different and competing incentives that influence their decision making. DApps can make decisions removing extraneous influences with greater flexibility in arriving at a data-driven decision. The developers can configure DApps that all token holders can vote on decisions ranging from how to spend funds, who to hire, where to invest, etc. The voting process can be set by weight, ranked voting, and other configurations.

COMMENTS